A systematic approach to investing

Systematic

sys·tem·at·ic

‘according to an agreed set of methods or organized plan’

We often refer to the way we invest as being a systematic approach. By this, we simply mean that we follow a disciplined, rules‑based, unemotional process. Markets move up and down all the time, and it can be tempting to try to react to every headline or short‑term change. Yet history shows that repeatedly guessing what markets or individual companies will do next is extremely difficult, even for professionals.

Figure 1: Fund managers are poor at beating the market

Data source: SPIVA® U.S. Mid-Year 2025. ‘All Domestic Funds’.

Our approach starts with building portfolios around long‑term targets for different types of investments. These targets are set carefully to capture the broad returns that stock and bond markets are expected to deliver over time, in exchange for taking on market risk. What we don’t do is try to second‑guess short‑term market moves or chase whatever is currently in the news. That may feel sensible, but the evidence suggests that very few people can do it successfully and consistently.

As markets move, the mix of investments in your portfolio will naturally drift from its original plan. We manage this by rebalancing - bringing the portfolio back to its intended structure at regular intervals. This involves selling what has done well, and buying more of what has done poorly. This keeps risk at the right level and helps you stay aligned with your long‑term goals, even though this can feel counterintuitive.

A key part of a systematic approach is choosing funds that are highly diversified, transparent and low cost. They are designed to capture broad market exposure rather than relying on a “star” fund manager picking a small number of companies. For example, if we want to access the potential for higher long‑term returns from smaller companies, we will use funds that hold a wide range of small‑cap shares, rather than a manager’s small selection of favourites. In a systematic strategy, returns come mainly from markets themselves - not from fund‑manager skill.

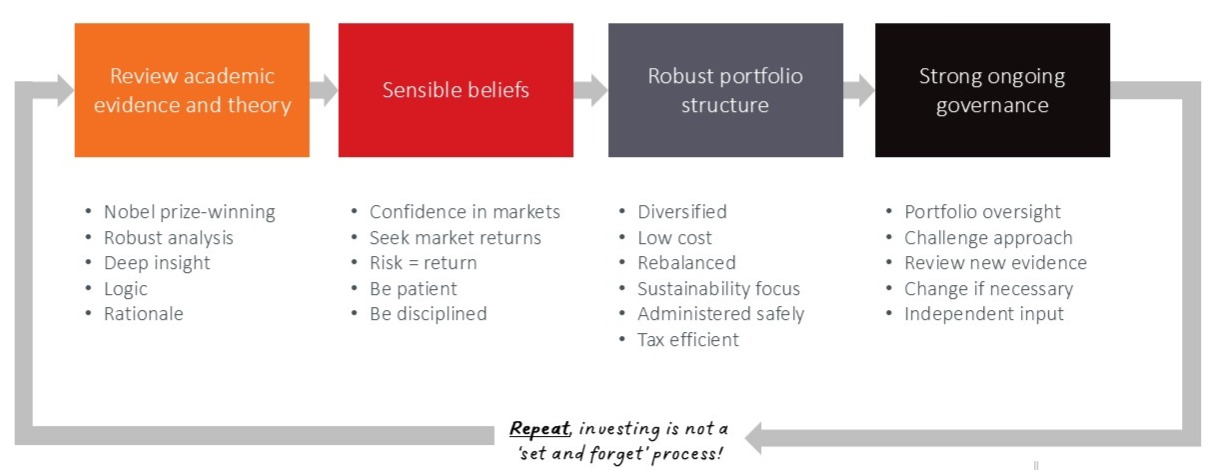

Finally, a key part of delivering this evidence‑based, systematic approach is the firm’s ongoing governance process. This governance is a disciplined, structured framework that continually tests whether our long‑term philosophy, asset allocations, and chosen funds still stack up against the latest academic research and product developments. By embedding this systematic discipline into a regular governance cycle, the Investment Committee ensures that every decision - or decision not to act, which is often the case - is intentional, considered, and aligned with giving clients the highest probability of a successful investment experience.

Figure 2: Build a sensible, repeatable approach

Source: Albion Strategic Consulting

We consider the opposite approach to systematic investing to be a judgmental approach. This requires casting judgment on direction and timing of stock and bond markets. It is clear, from the evidence, that few possess any ability to do so successfully and consistently through time. Sound process ensures an unbiased approach and that judgment does not creep into the investment solution.

Our systematic investment methodology is incorporated throughout each stage of the investment process, encompassing portfolio construction, ongoing reviews, and the selection of funds we recommend to you. It reduces the role of emotion, it avoids the temptation to ‘do something’ every time markets wobble, and it helps prevent the common mistakes investors make when reacting to short‑term noise.

Ultimately, a systematic approach to investing focuses on giving you the best chance of achieving your long‑term goals.

Best wishes

Important Notes

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to newsCategories

What our clients say...

"Mark was recommended to me, to assist in organising my finances following the untimely death of my husband in 2008. I was working full time, and had a heavy financial commitment to our small private nature reserve, to which I wanted to devote more of my...

Mrs A L, Northamptonshire (December 2017)