2025 - Looking backwards and forwards

Being an investor can be emotionally challenging. If we have a bad year (like 2022), we feel uncomfortable, and even after a couple of good years (2023 and 2024), we may still worry that some of the gains made might be lost going forward. This emotional asymmetry, where the pain of losses is felt twice as deeply as the pleasure of gains, is an innate bias that has deep evolutionary roots. While it kept us alive in our ancient past, it can be a hindrance for investors.

This time of year is often referred to as investing’s silly season, where analysts, fund managers, and economists make predictions about the markets for 2025. Any sensible pundit should suggest a rise in stock markets, as they tend to go up two-thirds of the time in any given year. Markets, however, reflect known information into prices quickly and effectively and prices will only move on the release of new information, which is unpredictable. Predicting what will happen in 2025 is essentially a bet against the market, implying that the guesser has better information, or interprets existing information better than the market, which is unlikely. As a long-term investor, you have the luxury of seeing past these short-term, random walks of the markets and the opportunity to pick up the rewards for taking on this uncertainty by remaining invested.

Our market forecasts for 2025 remain unchanged. They will go up, down or sideways!

Looking backwards

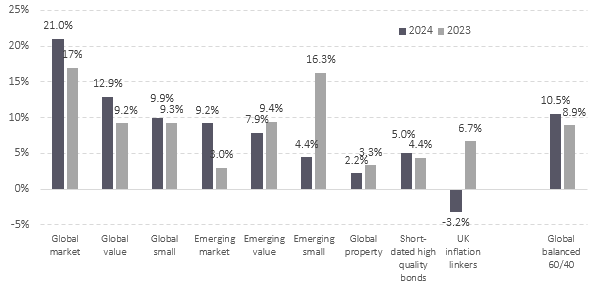

Last year was generally another good year for most markets as the chart below illustrates.

Figure 1: Global investment returns – 2024 and 2023 compared

Data: Live funds used to represent asset classes, in GBP. See endnote for details.

Like in 2023, the US market drove global stock market returns, with the ‘Magnificent Seven’ tech stocks driven by the focus on AI, interest rate cuts and the election of President Trump. These stocks alone contributed around 50% of the total US market gains of 27%. The combined developed and emerging markets delivered approximately 19%. It is always tempting to wish that one was invested only in Nvidia, the ‘Mag 7’, or the US market, but every investment has its day in the sun and being well-diversified pays off in the longer term. It is worth noting that investors in US stocks are currently willing to pay over $5 for every $1 of book value, which is at the same record high as in 2000 at the height of the dot.com mania before the crash (for those who can remember that time!). This is not a market timing signal, but a reminder that some stocks have much demanded of them in terms of the future earnings they are expected to deliver. Maybe they will deliver, maybe not. No one knows. Well-diversified global portfolios employing tilts to value and size, have a lower concentration risk to the ‘Mag 7’ as a consequence. Defensive, high quality, shorter-dated bonds delivered around 5%. UK inflation was down to 2.6% (to November) from 4% in 2023, which is good news.

A 60% stock/40% bond global balanced portfolio strategy[1] delivered a gross return of about 10% in 2024 which, after UK inflation, grew purchasing power by over 7%. That is a pretty positive outcome on the back of a good year in 2023. Over five years, a similarly structured portfolio would have returned over 30% (after fund costs, but before any other costs).

Looking forwards

There is no doubt that we are living in turbulent times, from the conflict in the Middle East, Russia’s war in Ukraine, China’s struggling economy and increasingly aggressive stance towards Taiwan, to the incipient presidency of Donald Trump in the US. Pressure on energy prices and a growing concern in bond markets about government debt levels and inflation have led to higher bond yields and the possibility – but not certainty - that interest rates could remain higher for longer. Trump’s tariff policies remain an unquantified threat to the global economy and inflation. A just end to the war in Ukraine would be a welcome, if hopeful, outcome for 2025. Uncertainty is the one forecast for 2025!

The old saying, ‘hope for the best but prepare for the worst’, is always a good mindset for investors. For those following an evidence-based, systematic approach to investing, starting 2025 with the expectation of positive equity, smaller company, and value premia is sensible. About one-third of the time, we will be disappointed in any one year. However, over time, the likelihood of capturing these premia increases. Being well-diversified is the key defence against bad times in some markets and sectors, and against specific companies’ fortunes.

It is important to remember that forward-looking views are already reflected in today’s prices. What comes next, no-one truly knows. As ever, the key is to remain highly diversified, resolute in the face of any market setbacks and focused on long-term goals.

For many of us, less doom-scrolling on our phones’ news apps would be a good New Year’s resolution. Perhaps download a positive news app instead (e.g. Squirrel News, Goodable or Positive News).

From an investing perspective, as ever, we remain hopeful for the best in 2025 but remain prepared for the worst.

"Choose to be optimistic, it feels better."

Dalai Lama

Happy New Year!

Best wishes

[1] See table below for example portfolio allocations. This is for illustrative purposes and does not reflect the performance or structure of any specific client portfolio.

Data series used

|

Asset class |

Fund |

ISIN |

Weight in 60/40 |

|

Gbl market |

Fidelity Index World P Acc |

GB00BJS8SJ34 |

27.5% |

|

Gbl value |

Dimensional Global Value GBP Acc |

IE00B3NVPH21 |

9.2% |

|

Gbl small cap |

Vanguard Glb Small-Cp Idx £ Acc |

IE00B3X1NT05 |

9.2% |

|

EM |

Fidelity Index Emerging Markets P Acc |

GB00BHZK8D21 |

4.9% |

|

EM value |

Dimensional Emerging Mkts Val GBP Acc |

IE00B0HCGX34 |

1.6% |

|

EM small cap |

iShares MSCI EM Small Cap ETF USD Dist |

IE00B3F81G20 |

1.6% |

|

Gbl property |

L&G Global Real Estate Div Index I Acc |

GB00BYW7CN38 |

6.0% |

|

Short, high qual bonds |

Dimensional Global Short Dated Bd Acc |

GB0033772848 |

36.0% |

|

UK IL gilts |

Dimensional £InflLnkdIntermDurFI GBP Acc |

IE00B3PVQJ91 |

4.0% |

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to news

Categories

What our clients say...

"Whilst we had always contributed to reasonable pension schemes, we never had what could be called good consistent financial planning advice. Career progression and subsequent business ownership required a much more coherent approach. So, it was with...

Mr & Mrs Cl, Berkshire (February 2018)