The Investment Committee - Paddling hard beneath the surface

Meeting your financial goals, so that you and your loved ones are free to live the lives you aspire to, requires high quality, ongoing financial planning and the construction and maintenance of a robust well-diversified, long-term investment strategy. It is the firm’s Investment Committee that is responsible for the ongoing governance of the latter.

In most walks of life when you employ a professional or craftsman, you expect a little bit of ‘action’ for your money. Now is generally better than later, and more is generally better than less. However, this generality does not apply in some areas. Take the case of a GP, for example, where a patient comes into the surgery with a very sore throat and flu-like symptoms. Today, many GPs feel under increasing pressure from patients to provide some ‘scientific’ solution – such as the prescription of anti-biotics - to their ailments and some feel cheated when the advice they receive is simply to take a couple of paracetamol tablets and go to bed for a day or two. Do we doubt the training, experience and wisdom of the GP because of the advice we receive? Hopefully not. After all science tells us that anti-biotics don’t work on viruses, only bacteria.

These same pressures apply to advisers, like us, when it comes to investing. Adopting an evidence-driven, systematic approach to investing can sometimes feel as if there is not much portfolio ‘action’. The evidence tells us not to try to time when to jump in or out of markets, pick individual stocks, or chase recent ‘hot’ funds, but to set a long-term strategy, populate it with excellent funds and rebalance it regularly. That takes much of the ‘action’ out of the portfolio. It would be wrong to think that this is the result of a set-and-forget strategy. Above the surface, it can seem that not much is going on, but that is far from reality.

Figure 1: Systematic investing – the view from a client’s perspective

Image source: Albion, generated using ChatGPT*

The seeming lack of investment activity on a portfolio from one period to the next belies the considerable time, effort, and discipline that goes into achieving this for our clients. The firm’s Investment Committee sits at the heart of this effort and one central question drives it efforts: ‘does the investment approach adopted still provide our clients with the greatest chance of a favourable investment experience, based on the latest evidence, theory and fund products available to us’. The Investment Committee is always open to challenge to the status quo. That said, the evidence in support of a systematic approach is highly compelling and any small portfolio changes that may arise are likely to be evolutionary, rather than revolutionary.

In reality, the Investment Committee is paddling away furiously to make sure that client portfolios remain robustly structured, issues and concerns are raised and resolved and that the incumbent funds used still remain best-in-class choices.

Figure 2: Systematic investing - the view from the Investment Committee’s perspective

Image source: Albion, generated using ChatGPT*

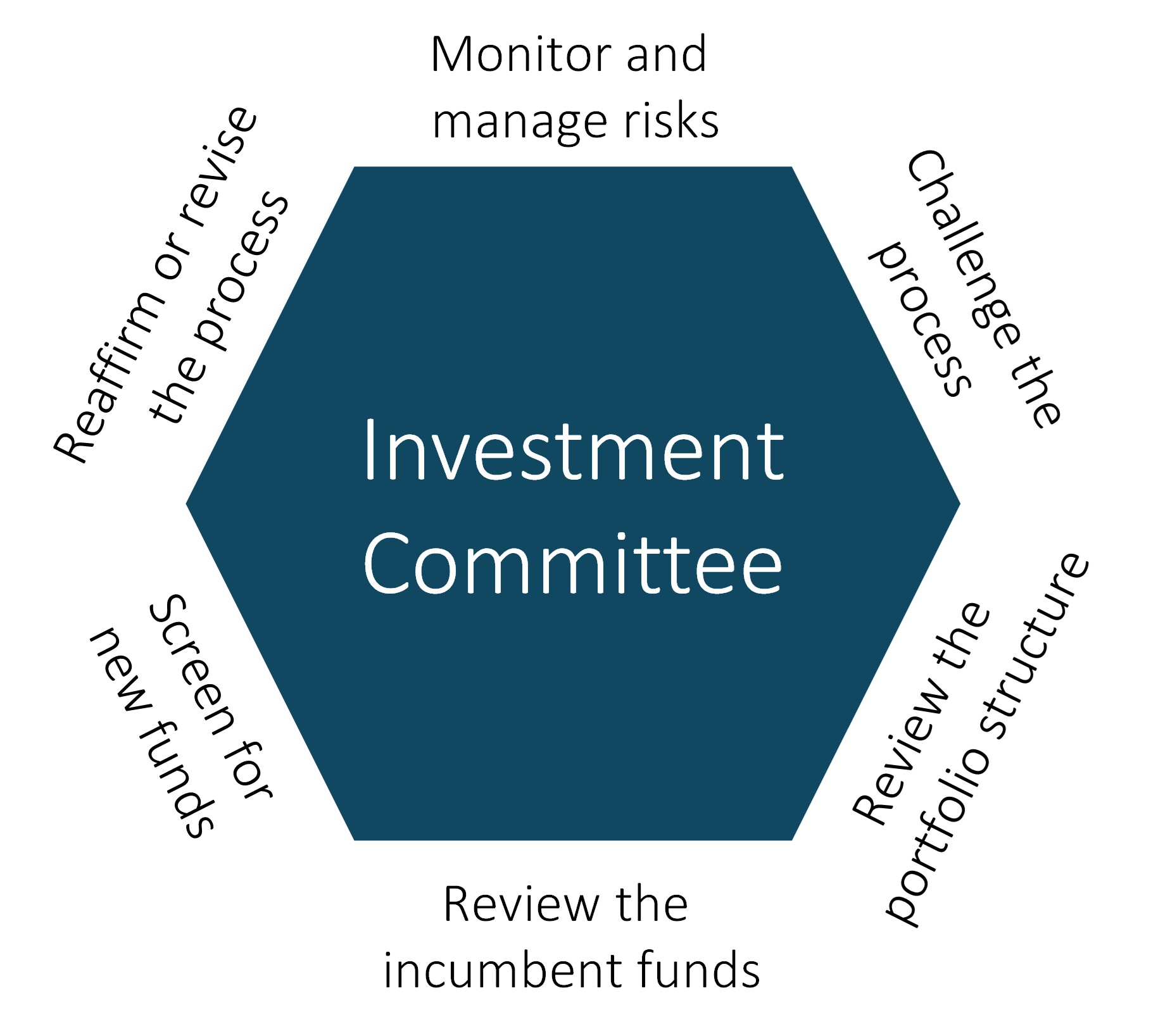

Ongoing oversight is both regular and robust. The chart below outlines the key responsibilities of the Investment Committee.

Figure 3: The Investment Committee provides ongoing governance of the process

Source: Albion Strategic Consulting

External, independent input

The firm works closely with Albion Strategic Consulting (Albion), who have been engaged to provide third-party, independent input and challenge to the Investment Committee, sitting as a guest member on it. Albion provides ongoing research on investment matters including reviewing the latest evidence supporting or challenging our approach at the philosophical, asset allocation and fund levels. Its inputs are reviewed and discussed in the meetings.

Less is more when it comes to investing

It takes fortitude and discipline to stay calm at times of market crisis, to remain invested and to rebalance the portfolio, if necessary. It takes fortitude and discipline not to chase ‘hot’ parts of the markets (bitcoin, gold, tech stocks etc.) or ‘hot’ managers, or to restructure the portfolio to take advantage of perceived short-term opportunities and challenges or giving up on certain parts of the diversified portfolio that happen to be suffering at any point in time.

It also takes fortitude and discipline to keep meeting with clients and to tell them again that, despite the fees they pay, their portfolio does not need changing (remembering that most of the fee relates to the financial planning work and advice they receive rather than the management of their portfolio). We will never change a portfolio just to look busy, but only when the change actually improves it.

The next time you open you latest portfolio valuation report, remember that despite the lack of activity on the surface, the Investment Committee continues to paddle furiously behind the scenes to allow this to be the case. In the immortal words of the investment legend and author Charles Ellis:

‘In investing, activity is almost always in surplus.’

Perhaps we should amend this slightly to:

‘In investing, activity is – except for within the Investment Committee – almost always in surplus.’

Best wishes

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to news

Categories

What our clients say...

We retired over 12 years ago after 20 years of running a busy consultancy the profits of which were steadily and successfully invested through Mark and his father before him.

Around the time of our retirement, Mark’s advice enabled us to...

Mr & Mrs Ch, Berkshire (February 2024)