Investment impact of the unfolding tragedy in the Middle East

Everyone has been touched by the horrific events and unfolding human tragedy in Israel and the Gaza Strip, and many are concerned by how this might escalate into a wider conflict at a time of great uncertainty in the world. People’s immediate focus is, rightly, on the plight of those caught up - either directly or indirectly - in the maelstrom of the conflict. We can only hope that some form of peaceful solution can be arrived at quickly, however hard or unlikely this may seem.

At such a time, it may feel a little inappropriate to be worried about the impact of ongoing events on investors and their portfolios. Yet, with many people feeling a great degree of uncertainty about the geopolitical events around the world, the cost of living crisis, the state of politics in many countries, not least the UK and the US, providing some reassurance may be welcome.

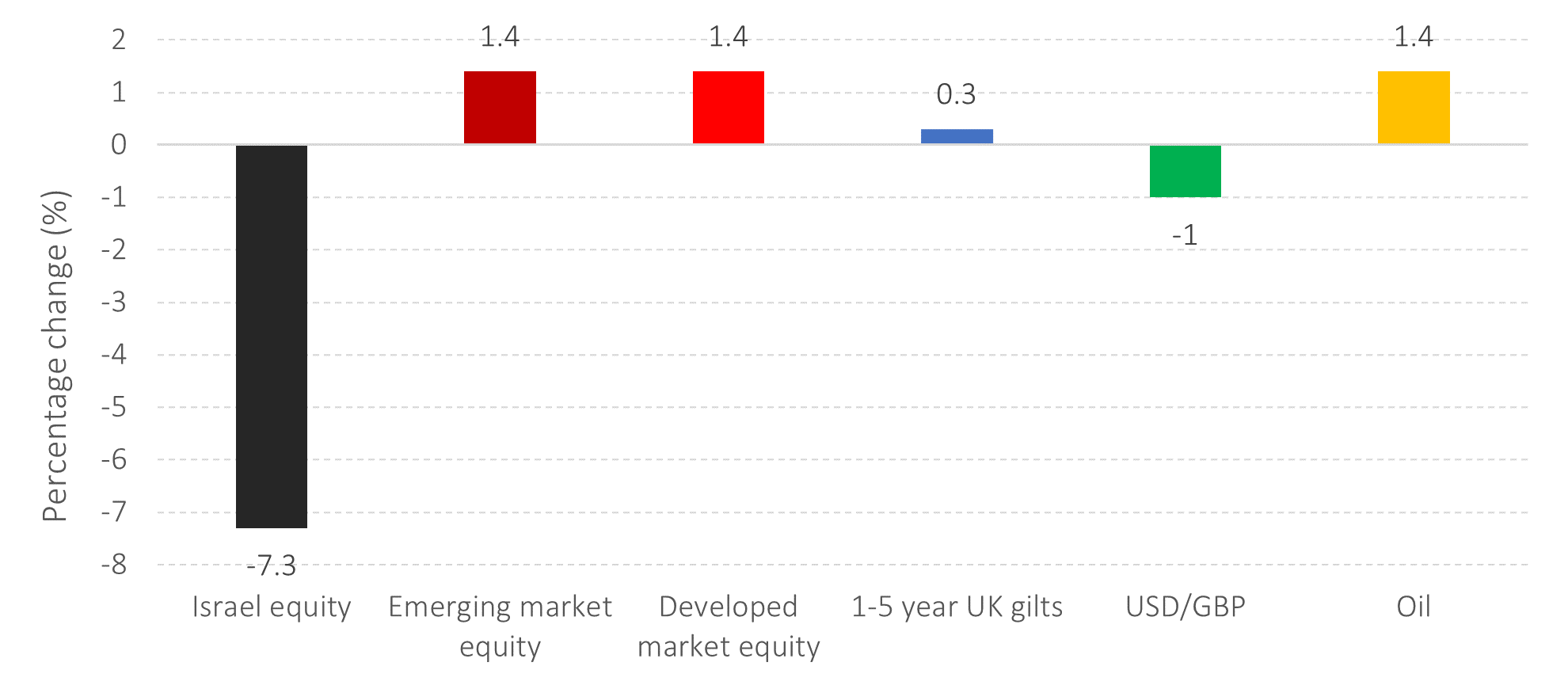

In the days since the weekend’s tragic events, the Israeli stock market has fallen by around 7%, in part due to the fall in the Israeli currency (the shekel). From a portfolio allocation perspective, the Israeli equity market (classified as a developed market) is only around 0.15%[1] of the world equity markets (developed and emerging markets combined). As such, any direct impact from the Israeli stock market will be negligible in a well-diversified portfolio. So far, other asset classes have not been materially affected. That is the easy part.

Figure 1: Asset class returns from 06-10-2023 to 11-10-2023

The hard part is trying to evaluate what the possible geopolitical, economic and investment market scenarios are that lie ahead and the likelihood that they might occur. At this point, the human mind (not least those of market commentators) tends to work overtime, trying to make sense of the vast interconnected nature of possible outcomes, by making up plausible stories. These tend to be in the form of conditional probability narratives starting with ‘If A happens, then the impact on B could be material, which could lead to C falling’. (In one possible scenario A = oil price rise, B = higher inflation, C = bond prices). Worrying news headlines can ensue. The question is, what can one do with such information? The truthful answer is not very much.

Fortunately, systematic investors with relatively long horizons can largely ignore these narratives and rely on the fact that they are all, in aggregate, already reflected in today’s market prices. Unless an investor has better information (or uses information better than others) they should probably not try to outguess markets at a time like this and remain sensibly invested in their long-term strategy.

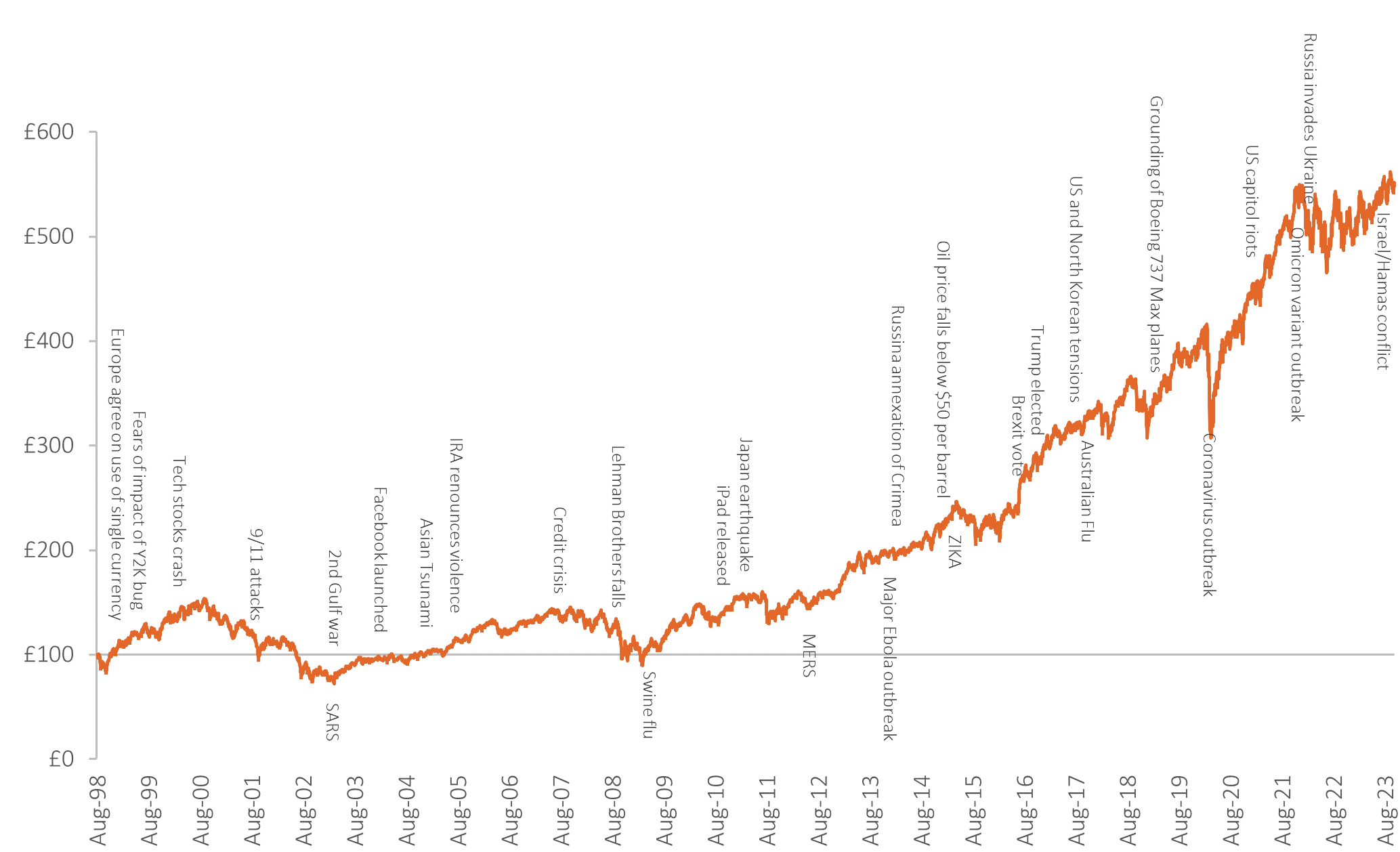

Things could end up worse than expected and equity markets might fall. No-one knows. There could be a flight to safe haven assets such as US Treasuries which would force yields down and bond prices up. Again, no-one knows. What investors with highly diversified portfolios do know, however, is that the countries, sectors and individual companies they own are many and varied and the bonds they hold are generally pretty defensive. This broad diversification should see them through any investment storms that they might encounter, today or in the future, as it has done successfully over the decades. As the chart below shows, investors who remain invested should be rewarded over time.

Figure 2: Global equities and world events Aug 1998 to 11 Oct 2023

The key is not to make any emotionally driven decisions – perhaps influenced by media headlines or your own narratives - and to remain invested. If necessary, get in touch with your adviser who will be happy to talk things through with you.

We hope for better times ahead for everyone.

Best wishes

[1] Based on its allocation in the iShares MSCI ACWI ETF USD Acc

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Data series used: global equities - Vanguard Global Stock Index $ Acc in GBP; global bonds - Dimensional Global Short Dated Bd Acc in GBP

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to news

Categories

What our clients say...

We retired over 12 years ago after 20 years of running a busy consultancy the profits of which were steadily and successfully invested through Mark and his father before him.

Around the time of our retirement, Mark’s advice enabled us to...

Mr & Mrs Ch, Berkshire (February 2024)