Long-term goals, short-term emotions

There is always a dynamic tension that exists between the sensible, well-thought-out long-term financial goals that investors set in place – often with the help of their financial adviser – and the emotions that they are likely to experience in the moment, as markets respond to new information and portfolio values are impacted.

This tension can sometimes be most acutely felt by both the investor and their adviser in the early stages of their relationship when a portfolio either goes down, or sideways in the first year or so. However, as much as one would like to start one’s investing experience with markets rising, the reality is obviously not always the case, as newer investors have recently experienced.

From the investor’s point of view, an aversion to loss, the feeling of loss of control and disappointment at seeing hard earned money falling in value can feel unsettling. From the adviser’s perspective it can also be a challenging time, knowing that however sound the financial plan, however sensible the portfolio asset allocation and however much time they have spent providing insight into the up and down journey a client will experience, emotions often trump logic when a portfolio shows a fall in value.

At such times it can be useful to reflect on a number of things:

- First, cash is the only investment that avoids losses, but only before inflation, and its low, long-term, after-inflation returns are unlikely to allow most investors to meet their financial goals, hence the need to add equities and bonds into the asset allocation. Do not be fooled by today’s high cash rates relative to recent years; they are a chimera for long-term investors and are not a substitute for a sensibly structured long-term portfolio designed to meet long-term goals. Do not be tempted by them.

- Second, it is the very uncertainty of the shorter-term outcomes of equities and bonds that delivers the longer-term, higher after-inflation returns that most investors need to meet these goals. The longer-term expected returns from a sensibly structured investment portfolio are far higher than those of cash.

- Third, returns come from markets not advisers, at least those employing a systematic approach to investing that aims to capture market returns. Blame should not be apportioned to an adviser because a portfolio has not gone up in value in the same way that praise should not be heaped on them if it has risen spectacularly! Markets are not predictable in the short term. Stay invested.

- Finally, falls in portfolio values are not losses and have every likelihood of recovering in time. Patience allows the longer-term expected returns to be realised. Avoid emotionally driven investment decisions that might impact these longer returns.

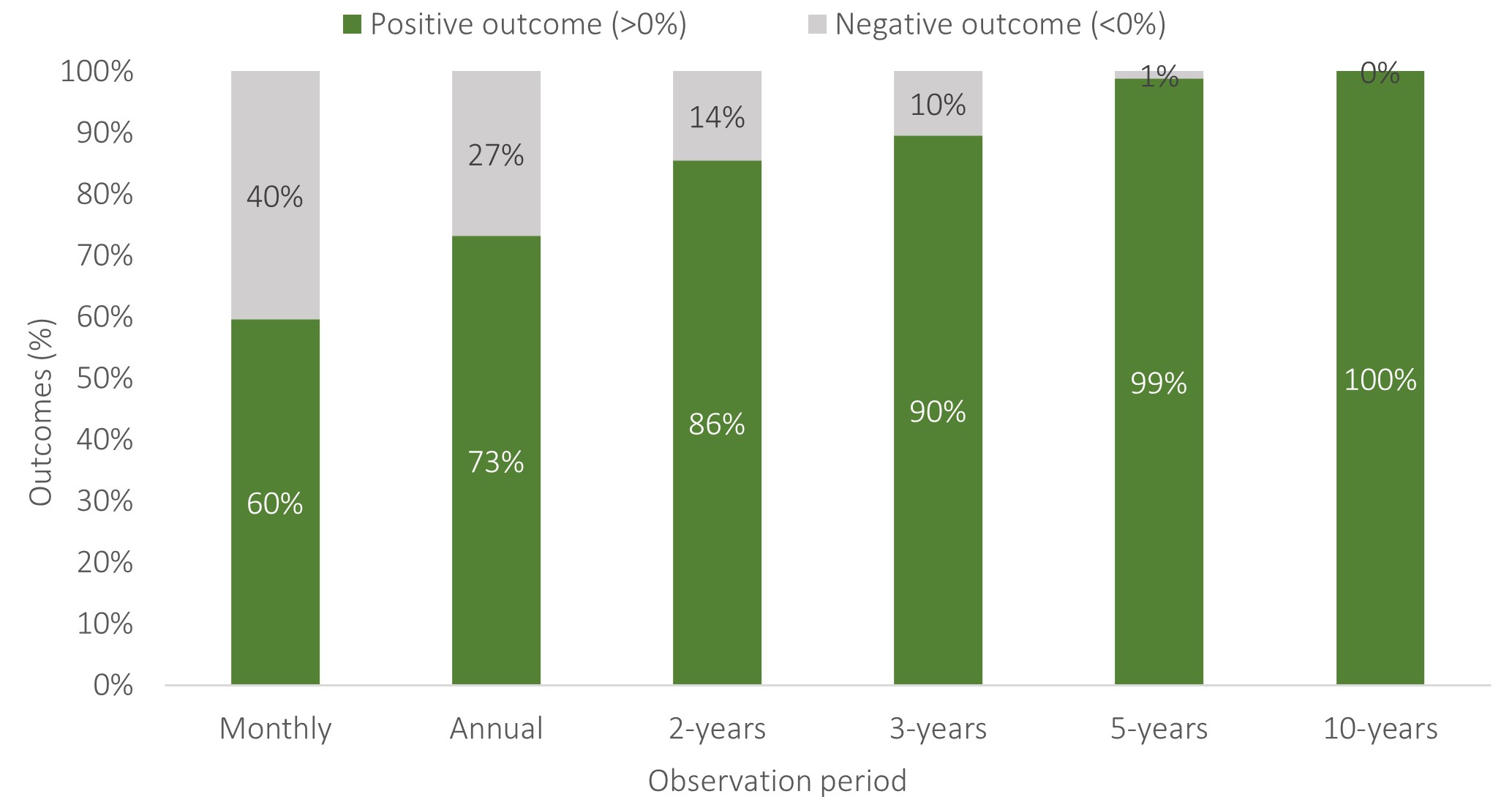

The chart below provides an insight into the proportion of times that investors in a 60% equity, 40% balanced portfolio have suffered falls in value over different time horizons. Whilst falls in purchasing power (i.e. after inflation) over two years are not uncommon, over five years – which is only a fraction of the time horizon of most investors – the chances of a fall decreases materially, based on data over the 34-year period reviewed.

Figure 1: The likelihood of gains in purchasing power (07-1989 to 08-2023)

Data: 60/40 global balanced portfolio from 07-1989 to 08-2023[1]

If you are a new investor, keep the faith and remain invested for the long term because that is what is required to give yourself a chance of meeting your long-term goals. If you have been investing for some time and been through one of more cycles of market falls and recoveries, hopefully the tension between longer-term goals and short-term emotions will be greatly tempered.

As Charlie Munger, Vice Chairman of Berkshire Hathaway once said: ‘The big money is…in the waiting’

Best wishes

[1] Global equity model portfolio with tilts to value and smaller companies and global commercial property, balanced by higher-quality, shorter-dated bonds (full details of market indices used available on request). No costs of any kind have been deducted. For illustration purposes only (see ‘Risk warning’ below)

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Data series used: global equities - Vanguard Global Stock Index $ Acc in GBP; global bonds - Dimensional Global Short Dated Bd Acc in GBP

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to newsCategories

What our clients say...

"Mark was recommended to me, to assist in organising my finances following the untimely death of my husband in 2008. I was working full time, and had a heavy financial commitment to our small private nature reserve, to which I wanted to devote more of my...

Mrs A L, Northamptonshire (December 2017)