The error of reacting to market falls

Being an investor is never easy because, as humans, we tend to live in the moment responding to our emotions, the environment around us and the circumstances we find ourselves in. From an evolutionary standpoint that has served us well as a species helping us to survive, but as investors we need to remain focused on the long-term goals that we have and not what is going on in the day-to-day, month-to-month or even year-to-year of the markets. This is evident from the two charts below.

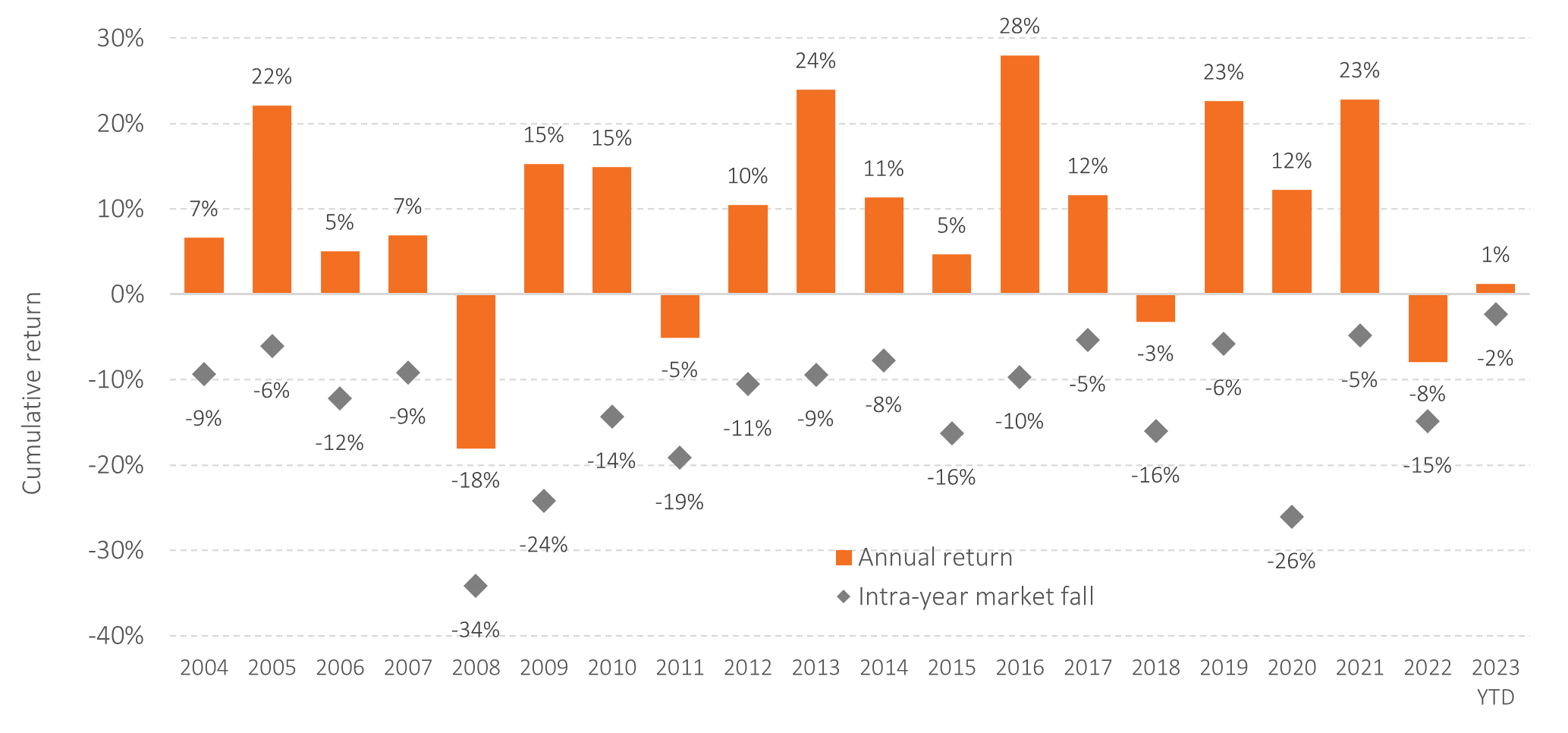

Each of these charts show that if we listen to this noise, we would spend most of our time being afraid of markets instead of embracing them for the returns that taking on sensible risks should deliver. In equity market parlance, a ‘correction’ is deemed to be a fall of 10% or more and a ‘bear market’ is a fall of 20% or more. The columns are the annual returns of the market, and the diamonds represent the magnitude of fall from the market high in that year.

Figure 1: Global equity markets fall from a high every single year

Data: Live fund data used to represent asset classes, in GBP. See endnote for details.

It is pretty evident that any investor looking to profit from this would need some amazing form of 20-20 foresight to predict these short-term market movements, acting in advance of them happening and then getting back into the market again at the appropriate time. Simply reacting, post-event, to market falls will invariably be a losing strategy. In reality, at any point in time, all of the information held by all investors trading in markets is reflected in current prices quite efficiently. Prices will therefore move only on the release of new information, which is by definition a random event. As the Nobel Laureate Professor Robert Merton recently stated[1]:

‘If the market is disagreeing with me, or doesn’t seem to be aligned with me, that could be that I know things the market doesn’t, but it also could be that the market knows things [I] don’t!’

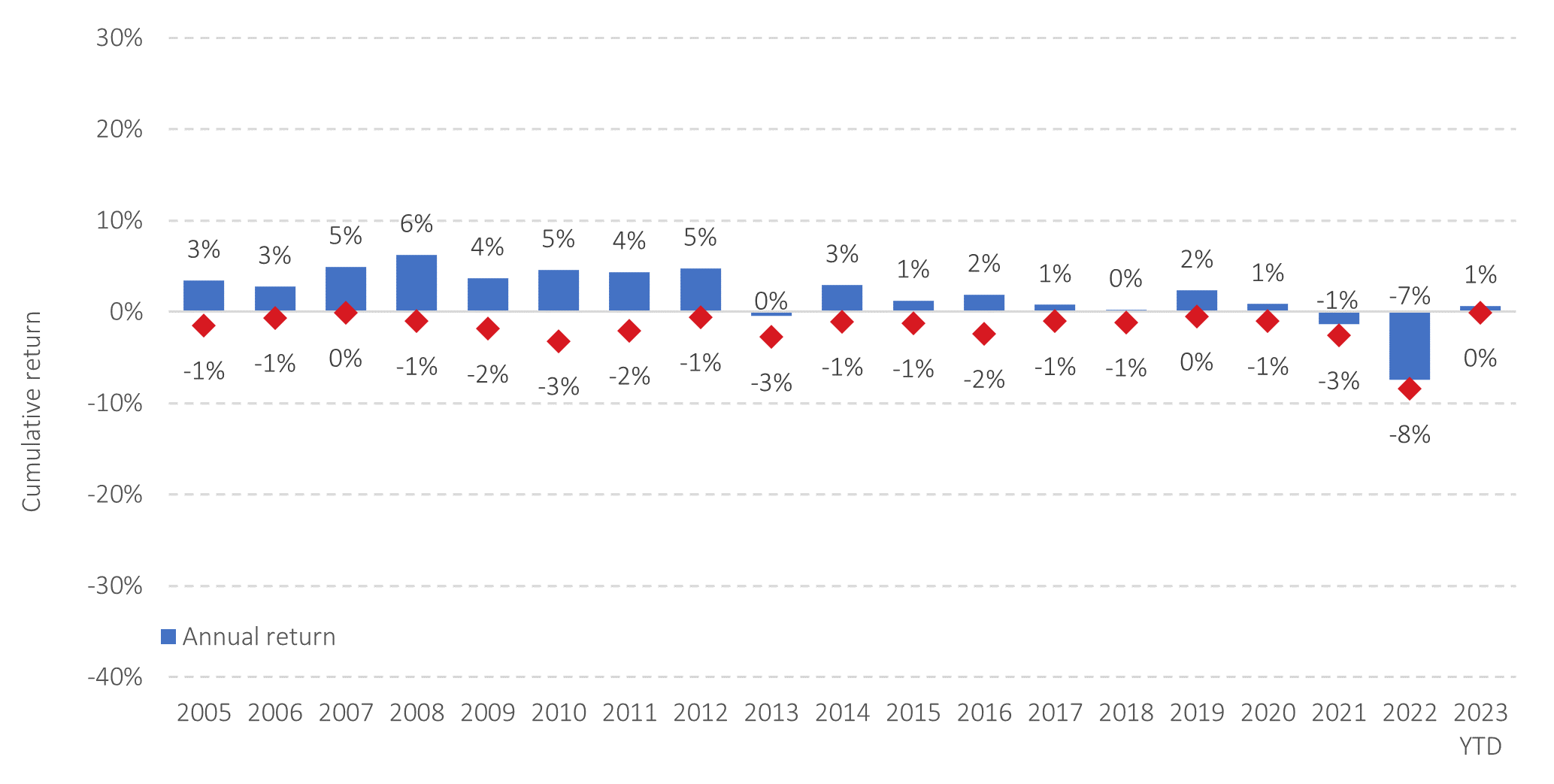

Investors were reminded in 2022 that bond returns can go down as well as up. The same challenge in terms of reacting to falls in bond markets applies. In almost every year, bond markets fall from an intra-year high.

Figure 2: Global bond markets also fall from a high every single year

Data: Live fund data used to represent asset classes, in GBP. See endnote for details.

Trying to time when to be in or out of bonds – and presumably into cash – could result in eroding away the term and credit premia that a sensible structure of short-dated global bonds hedged to Sterling has the opportunity to provide for those focused on their true investment horizons.

As the wise industry consultant and author Charles Ellis states:

‘In investing, activity is almost always in surplus!’

We agree. Remain focused on your long-term goals, stay invested and rebalance regularly, for a simpler life and the likelihood of better outcomes.

Best wishes

Risk warnings

This article is distributed for educational purposes only and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Reference to specific products is made only to help make educational points. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Data series used: global equities - Vanguard Global Stock Index $ Acc in GBP; global bonds - Dimensional Global Short Dated Bd Acc in GBP

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

[1] Rational Reminder podcast January 5, 2023 - Episode 234. This episode is really worth listening to https://rationalreminder.ca/podcast/2

Return to newsCategories

What our clients say...

"It is now approaching twenty five years (in 2023) since we started receiving advice from Mark. We feel fortunate that we were introduced to him all those years ago, and that he has continued to provide us with, what we regard, as sound and non-sales...

Mr & Mrs R, Birmingham (December 2023)