2022 - Looking backwards & forwards

Anyone relatively new to investing could be forgiven for thinking that it is a simple game and easy to make money i.e. punt on what is going up most and buy the dips. Perhaps even those who have been investing for a decade or more might be thinking the same. In this short note we take a quick look back at what has happened in the recent past and how best to structure a portfolio today for the years ahead, given that we live and invest in an uncertain world.

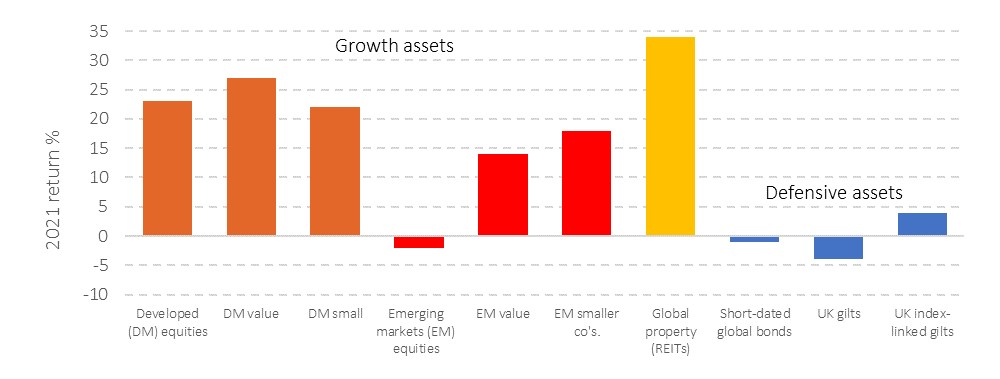

This time last year, investors were perhaps both astonished and relieved that global markets returned strong positive returns, despite the global lockdown of societies and economies as Covid struck. Another year on and 2021 has delivered yet more strong returns in most risk assets, including value stocks, despite the ongoing pandemic and rising inflation around the world. Some individual stocks, such as Tesla (up around 50%), have been spectacular.

Figure 1: Global investment returns – sensible assets 2021

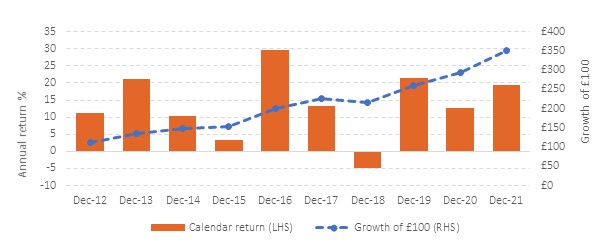

Looking back a decade, the chart below illustrates the exceptional returns delivered by broadly diversified global equity markets and the power of compounding. The columns represent each calendar year’s return, and the line shows the cumulative impact of compounding strong returns year-on-year. Over this period global equities more than tripled in value (before costs) yet suffered only one small calendar year downturn in 2018, delivering a compound return of over 13% per year. In anyone’s book, these are exceptional returns in light of UK inflation of around 2% per year over this same period.

Any well-diversified investor dissatisfied by their portfolio returns should take a long, hard look at historical returns. The long-run return of global equities has averaged around 5% above inflation since 1900[1] and this ‘average’ return was interspersed with bouts of prolonged and painful market downturns, the last being the 2007-2009 Global Financial Crisis, when the UK equity market fell by over 40%. It is not always so easy being an investor.

Figure 2: Global (developed and emerging) equity returns over the past ten years (2012 to 2021)

Looking forwards

The fear of missing out (FOMO) risks leading some investors into dangerous hindsight-driven portfolio construction decisions: from buying assets that don’t earn their long-term place in portfolios e.g. Bitcoin (+60% in 2021); to concentrated bets e.g., US ten largest companies (up more than 30%); to those that are purely speculative ‘meme’ stocks e.g. AMC Entertainment (up a literally unbelievable 1,195%). The old investment saying of ‘up like a rocket, down like a stick’ springs to mind.

The challenge that investors face is that they own a portfolio today, which needs to be robust enough to navigate a highly uncertain tomorrow and deliver the long-term returns needed to fund their financial plan. Being influenced by what has done well recently, or what some think will do well, risks owning a portfolio aiming for stellar returns but lacking robustness in face of this future uncertainty. To be so certain about what will do well in the future risks hubris; being right relies on either supreme (and extremely rare) insight or luck. This dilemma is elegantly summed up by James Montier[2], who incidentally wrote one of the most readable (and short) books on how investors behave[3]:

‘Ex-post [after the event] I can always tell you what was the best performing asset and why you should have had 100% of your capital in it. But it’s not a very useful ex-ante, before-the-fact, kind of framing. So I think that when you are building a portfolio, really what you want to do is build a portfolio that can withstand as many different outcomes as is possible. What that means, of course, is that you are not going to have the portfolio that does best in whatever outcome actually transpires and that can be a very hard thing for investors to kind of accept.’

Maintaining a robust portfolio in face of the uncertain world we live in continues to be an important focus in ensuring satisfactory longer-term outcomes.

There are today - as Donald Rumsfeld might have said – known-knowns such as high and increasingly stubborn global inflation, rising energy prices, and the likelihood of a general tightening of monetary policy including a reduction in, or end to, quantitative easing including in the US and the UK. We also know that much of the success of US stocks, in particular in the past few years, has been driven by an increase in the multiple of company earnings that investors are willing to pay to own a company’s shares. Apple, for example, which is now worth around US$3 trillion, has seen its price rise from the start of 2018 from US$38 to US$182 at the end of 2021. In this time, its price-to-earnings multiple has risen from around 12.5 times to 32 times[4]. There is a risk that the spectacular returns of some stocks have, in effect, borrowed from future returns. Only time will tell.

There are known-unknowns such as the future course of the pandemic, the direction of the geopolitical risks presented by Russia, China and Iran and their impact on global stability and growth. Finally, there are unknown-unknowns, or black swan events, that carry a low probability of occurring but could have extreme outcomes that always exist. If we knew what they were, they would not be unknown! Remember that it is this very uncertainty that rewards investors in equities with positive returns above inflation over the longer term.

Trying to unravel exactly how these forces will play out in bond and equity markets in 2022 and beyond requires a crystal ball that no-one possesses. The aggregate view of all investors is reflected in market prices which are always hard to outguess.

In a sense that does make investing relatively simple: own the right level of defensive assets that provide a close match to your short and medium term liabilities, which you can rely on if markets are less kind than the recent past. Capture the returns that global equity markets do deliver and avoid the hubristic claims of superior insight in an attempt to shoot the lights out on performance. The latter approach is both risky and unnecessary.

And finally…

On a more human note, we perhaps should reflect back on the bleak episode that the world has faced in the past year or two and be thankful for the skill of the scientists and the courage and dedication of healthcare workers, the resilience of the large and small businesses who have stared bankruptcy in the face and survived and have empathy for those who have suffered. We should be thankful too that we live in a rich and open society that possesses the resources to try to mitigate at least some of the financial pain of many.

Looking forward, let us hope for better times in 2022. As far as markets are concerned, they will go up, down or sideways in 2022 and anyone who pretends they know which, does not! Rely on the broad and robust structure of your portfolio to stand up to the uncertainty of what lies ahead. Remember, life is too short to look at your portfolio too often. If it is well-structured, there is little to be gained from doing so.

Enjoy 2022 and all the richness it can offer and the joy it may bring.

Best wishes

[1] Dimson, Marsh and Staunton, Credit Suisse Returns Yearbook, 2021. https://www.credit-suisse.com/about-us/en/reports-research/studies-publications.html

[2] Morningstar Podcasts The Long View: James Montier: 'How Do I Get Paid for Owning This Asset?' https://www.morningstar.com/podcasts/the-long-view/11

[3] Add this to your bookcase, it is well worth a read: The Little Book of Behavioral Investing: How not to be your own worst enemy, by James Montier, ISBN: 978-0-470-68602-7

[4] See: https://www.macrotrends.net/stocks/charts/AAPL/apple/pe-ratio

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Somnium Financial Planning Ltd cannot be held repsonsible for the content of external links.

Return to news

Categories

What our clients say...

"It is now approaching twenty five years (in 2023) since we started receiving advice from Mark. We feel fortunate that we were introduced to him all those years ago, and that he has continued to provide us with, what we regard, as sound and non-sales...

Mr & Mrs R, Birmingham (December 2023)