2020 - What a year!

2020 will certainly go down in history as a momentous year, with the tragedy that is Covid-19, the painful global downturn that has ensued, the major curbs on personal freedom and the end of one of the most divisive presidencies in the US, carrying the headlines. What will almost certainly be a forgotten as a footnote to the year is the fact that it is looking likely global equities will finish the year slightly up on where they started it.

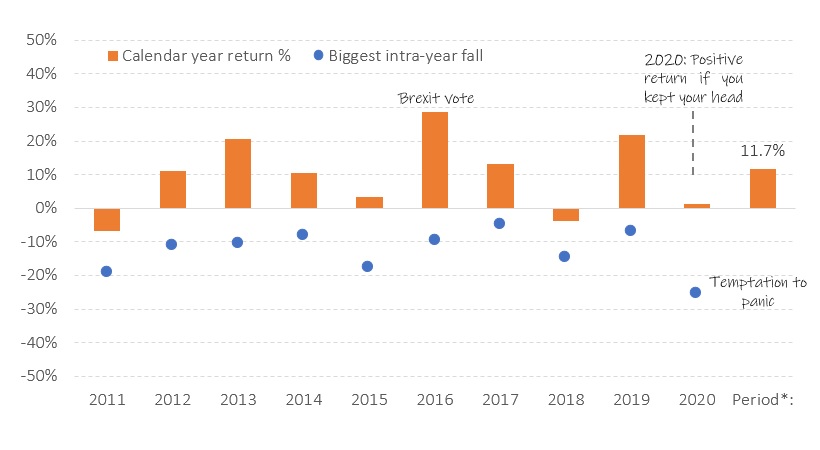

Yet that is to belie the still raw memory of some of the most severe daily and weekly market falls - and subsequent rapid rises – that investors have ever experienced. Such moments in markets can be discombobulating and, when emotions kick in, can lead to poor decision-making. Being tempted to act on market falls – or the perceived prospect of market falls – is extremely risky and likely to harm your portfolio. Take a look at the chart below that shows the annual return of developed and emerging markets in aggregate (column) and the intra-year fall from that year’s market high (dot). 2020 is a good example: the market fell around 25% but is now above its starting point. Likewise for 2016, which saw an awful start to the year and the Brexit vote, yet the markets ended almost 30% up. Just hanging in there resulted in an annualised return of over 11% over this almost 10-year period, which meant that investors doubled their assets every seven years or so. That is a great outcome.

Figure 1: Responding to market falls is not a good idea

Data source: World equities in GBP 1/2011 to 11/2020

So, when you look back on 2020, just leave your thoughts about the markets in the footnote where it belongs.

Many other things were far more important. Let’s hope 2021 brings more joy.

Wishing you a safe Christmas and look forward to seeing you in 2021.

Best wishes

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

Return to news

Categories

What our clients say...

We retired over 12 years ago after 20 years of running a busy consultancy the profits of which were steadily and successfully invested through Mark and his father before him.

Around the time of our retirement, Mark’s advice enabled us to...

Mr & Mrs Ch, Berkshire (February 2024)